Reserve Asset Class

New Chart: Bitcoin Priced in Gold

Dear Bitcoiners,

The arms race for Bitcoin as a strategic reserve asset has begun! It’s no longer a question of if but when more countries, after El Salvador, will add Bitcoin to their reserves. With the U.S. pro-Bitcoin stance, Bitcoin has become a topic of discussion among nations, both in positive and negative light. This week, European Central Bank (ECB) President Christine Lagarde, who has previously dismissed the $2 trillion asset class as worthless, claimed she was "confident" that Bitcoin won’t enter the ECB’s reserves, arguing that it is not "liquid, secure, or safe." A bold statement, considering Bitcoin is one of the most global and liquid markets, trading 24/7, and secured by the most powerful computer network, currently operating at 740 exahashes per second. At the same time, a proposal to add Bitcoin as a reserve asset is under review by the Czech Republic’s central bank.

Meanwhile, in the U.S., with the shift to a pro-Bitcoin administration, Fed Chair Jerome Powell acknowledged at this week’s meeting that banks are allowed to offer Bitcoin and crypto services. And as we await the U.S. Digital Asset Stockpile report over the next six months, many U.S. states are actively competing to establish their own Bitcoin Strategic Reserves!

One of these days, one of these proposals will be signed into law and set a precedent, just as we saw with El Salvador. However, that precedent might take a full cycle, as we saw with Bukele, who was heavily criticized during the bear market but has now emerged as a leader with incredible vision.

Tracking Institutional Adoption: Soon Coming to Bitcoin Strategy

On the institutional front, there is heavy demand for Bitcoin! MicroStrategy’s preferred stock offering was overbid by nearly three times. They raised $584 million, enough to buy over 5,500 BTC.

Meanwhile, ETF inflows remain strong, with IBIT alone nearly adding 20,000 BTC in the past two weeks, as tracked by our ETF Tracker:

I am currently developing a new metric to track institutional adoption, mapping out how much ETF Bitcoin is held by institutions vs. retail. This will provide deeper insights into the scale of institutional participation, expanding on data like 13F filings, which reveal significant insights—for example, Goldman Sachs holds over 8,000 BTC in ETFs and also owns $350 million worth of MicroStrategy shares, equivalent to another ~2,750 BTC. This is just one of many institutions increasing their Bitcoin exposure, a trend that has largely gone untracked until now.

More details on Tracking Institutional Adoption are coming soon!

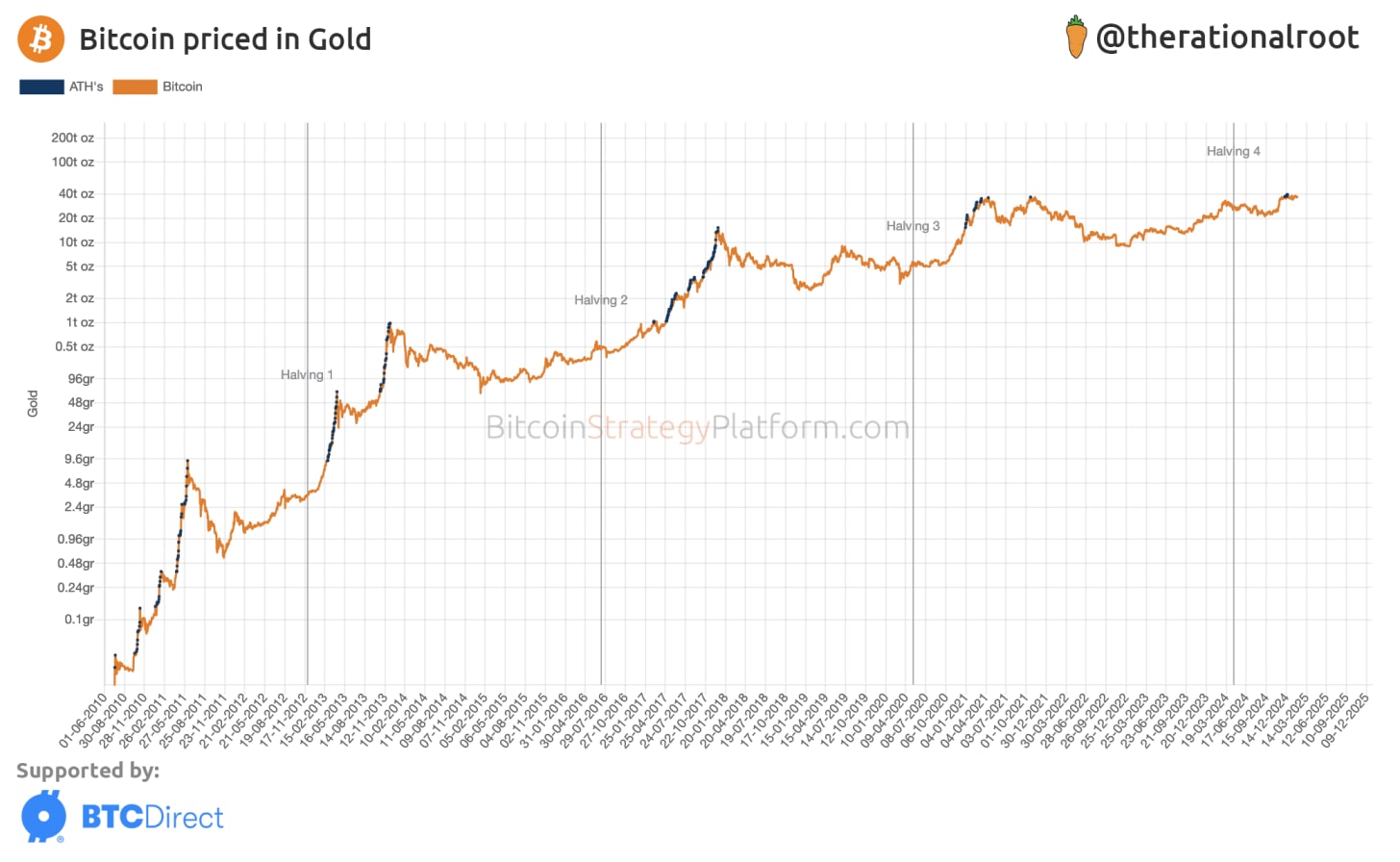

Reserve Asset Class: Bitcoin vs. Gold

With Bitcoin emerging as a reserve asset, let’s compare it to its analog counterpart: gold. Gold has long been a hedge against economic uncertainty and inflation. Interestingly, Bitcoin only recently hit an all-time high when priced in gold—unlike in dollars, where the breakout began after the ETF approval.

Measured from the previous ATH, Bitcoin’s recent ATH in gold aligns much closer to the 4-year cycle than its ETF-approval peak when measured in USD. This chart suggests Bitcoin’s full-blown bull market has only recently started and could have much more upside ahead.

This is a key chart to track alongside Bitcoin’s dollar price—now live on the Bitcoin Strategy Platform. Available in both grams and troy ounces!

👉 Key Insight: This cycle, we’ve only seen 7 blue dots (ATHs) against gold, whereas 24 when measured in USD.

If you haven’t yet become a paid member of Bitcoin Strategy, now is the time! Gain full access to all curated charts & indicators, and premium insights—all in one place —to help you stay fully prepared for Bitcoin's cycle. Claim your 25% LIFETIME discount today!

Hopefully you find the newly added charts useful, and stay tuned—much more is coming! As always, your feedback is greatly appreciated, so please like, share, and leave your thoughts in the comments. 🧡 👊

Until next week! 🫡

-Root

I’ve been watching btc vs gold for a while and it seems critical, thanks for including it in your charts. The gold unit bias is also evident if you dig in further.

Inspired as usual. Thank you Root.