The 3 Stages: Recovery Coming to an End!

Outperforming Previous Cycles

Hello Bitcoiners!

Bitcoin is hovering around $61,000, just below key levels (available to paid subscribers) like the STH cost basis. For the past few months, we’ve been moving sideways, surely testing our patience. With Bitcoin remaining in its sideways channel, some might question whether we are still in a bull market.

In this newsletter, we’ll revisit the 3 stages of the 4-year cycle—a topic of great importance. It’s been a year since our last newsletter on these 3 stages, and it’s remarkable how accurately everything has played out since then. It’s definitely worth revisiting the previous article on timing.

Also, in our last newsletter, we discussed the importance of Global Liquidity and the likelihood of a recession. If you missed that, I highly recommend checking it out.

The 3 Stages

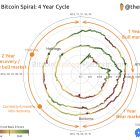

The Bitcoin 4-year cycle can be subdivided into 3 stages: the parabolic move, the drawdown, and the recovery stage.

1 year: Parabolic rise

1 year: ~80% drop to a new plateau!

2 years: Recovery

Note that the recovery stage is twice as long as the other stages and contains many psychological hurdles, such as the enduring phase, stagnation, disbelief, doubt, and a calm phase. For more on these psychological phases, refer to the Bitcoin Cheat Sheet where I cover them in detail.

These psychological hurdles test our patience, especially now that we are 1.5 years into the recovery process. The good news is that the recovery stage is coming to an end, and your patience will be rewarded.

Get access to premium live indicators, charts, and full newsletter content—sign up now and receive a 25% lifetime discount.

What comes next is a stage of hype, triggering a parabolic move to unsustainable new heights. Will this time be different? I don’t pretend to know what the future holds—there will always be uncertainty. This time, it’s mainly recessionary fears. People have missed out on the entire recovery due to these fears, and they might also miss the parabolic move!

Warning: You can miss parts of the recovery process, but missing out on the parabolic move may be very costly.

In the next section, we’ll discuss the current cycle’s performance and how it has been outperforming previous cycles. If you’ve found this newsletter interesting so far, you’ll definitely want to check out the next charts and insights!