Price action & Short-Term Holder Trendline

Bitcoin vs. S&P 500, STH cost basis + New Chart!

One of the most powerful On-Chain metrics is the Short-Term Holder cost basis — also known as the ‘STH realized price’ — which represents the average purchase price of young holders and helps to distinguish between bull and bear markets.

While we slightly dropped below the STH cost basis, we never got confirmation to continue a bearish trend (I mentioned this in 👉 Bitcoin Price Forecast - Part 2). Confirmation happens when we first drop below, move back up and than reject once more off the STH cost basis. In this instance, instead of rejecting, we shot right back into bull territory.

The reason Bitcoin initially dropped below the STH cost basis was due to the crypto crackdown with the SEC going after Binance and Coinbase for offering crypto securities. The news of BlackRock filing for an ETF completely countered that negative sentiment.

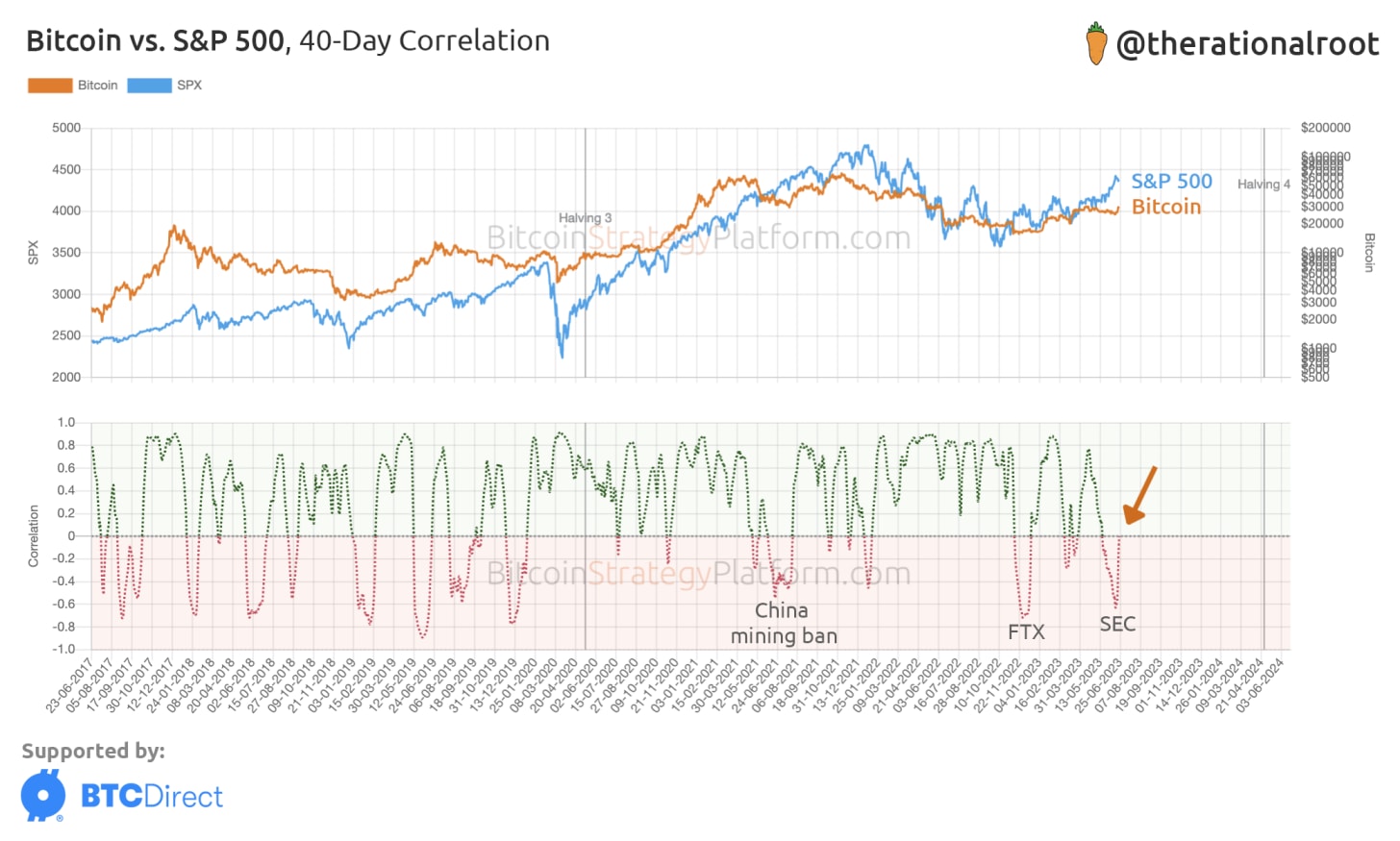

The SEC crackdown caused Bitcoin to temporarily decorrelate from the S&P 500. However, as shown in the chart below, the pump above $30,000 restored that correlation (orange arrow).

👆 View live chart at the Bitcoin Strategy Platform.

We therefore are back to as if nothing happened!

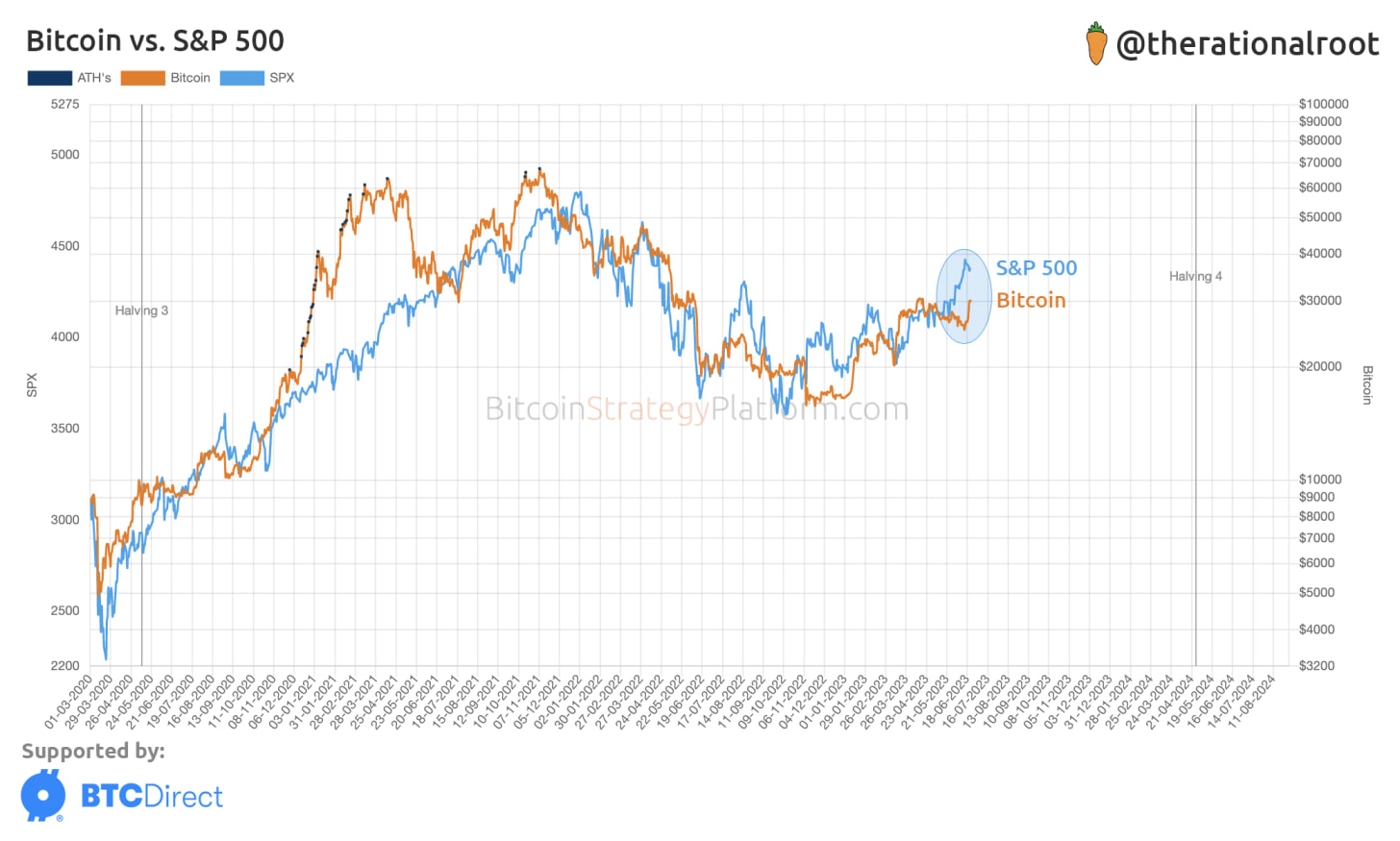

While sentiment on twitter the last couple of days made you feel Bitcoin was doing extrordinarily well, reality is that due to the SEC crackdown bitcoin underperformed and is now recovering to be back on par with the S&P 500. Note how in the chart below the gap is closing (blue circle).

👆 View live chart at the Bitcoin Strategy Platform.

Regarding BlackRock, it is true that their filing for an ETF can potentially open up the floodgates for new liquidity to enter the space. However, people have been talking about ETF floodgates since 2013! This time different? Perhaps, because BlackRock has an extremely high approval rate, yet getting an ETF approved is still a process that takes months.

Get access to the Bitcoin Strategy Platform with LIVE charts & Full content. 30% discount ending soon!

A spot ETF can surely serve as a catalyst for the next cycle in terms of price action. The downside is that an ETF is custodial, a claim to the asset rather than the bearer asset itself, going against Bitcoin’s culture surrounding self-custody.

Now that we’ve tempered our excitement around BlackRock a bit, let's continue with a realistic view for the near term. First, we'll examine a trendline that has remained consistent in each Bitcoin cycle concerning the STH cost basis. Then, we'll address the potential risks moving forward.

In below chart we see Bitcoin’s price, the STH cost basis and the Trendline.