Paper Bitcoin Unraveled

Navigating ETFs, Price Suppression, Gold Comparisons, and Altcoin Impact

Hello Bitcoin Enthusiasts,

Last week, we delved into the complicated world of derivatives, focusing specifically on futures contracts and how they can impact Bitcoin's price and supply discovery mechanisms. In case you missed it, you can find it here:

Today, we extend our exploration of ‘paper Bitcoin’ to consider other key factors shaping the Bitcoin market. Our discussion will cover:

IOUs and the subtleties of custodial arrangements,

The ramifications of introducing a Spot ETF,

Comparisons between Bitcoin and Gold Spot ETFs,

And the influence exerted by altcoins on Bitcoin’s capital flow.

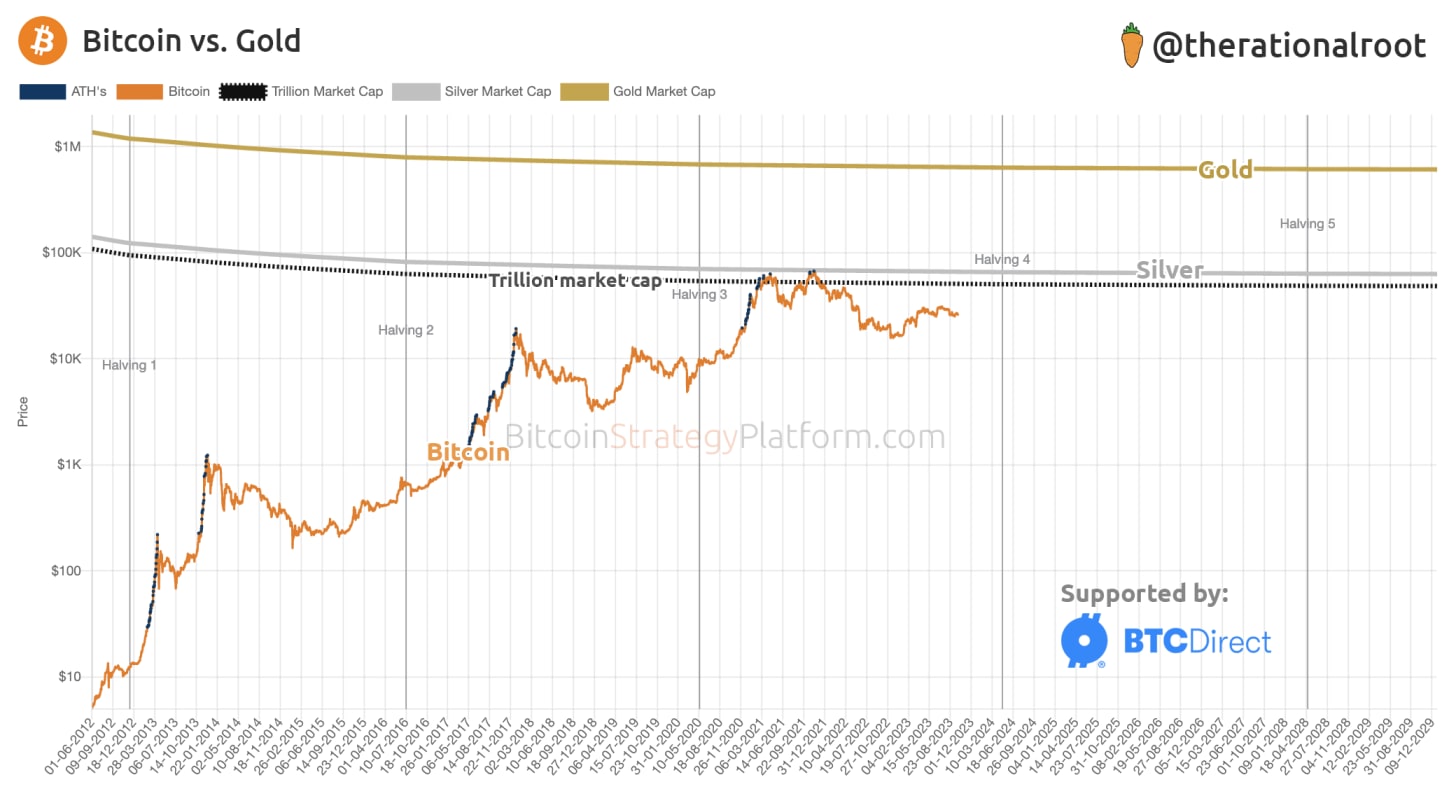

Chart: Bitcoin vs. Silver & Gold

IOUs: The Complexities of Custody

IOUs, short for "I Owe You," is simply a promise between two parties. When you deposit your Bitcoin into an exchange, you're actually stepping into a custodial arrangement. You essentially give up self-custody of your digital asset, and the exchange provides you with an IOU as an assurance. These IOUs are fundamental to exchanges' ability to offer competitive prices—maintaining an on-chain record of every trade would be prohibitively expensive.

However, this creates a significant issue: the auditability of these exchanges. FTX and other similar platforms have been caught red-handed, diverting customer funds for other ventures. This can result in a fractional reserve system, much like the traditional banks we're familiar with, and it can have profound implications on Bitcoin's price discovery process. You might have purchased a BTC-IOU with USD, but the custodian may not have acquired the underlying Bitcoin, effectively suppressing its price.