Market Analysis: Is Gold Telling Where Bitcoin Is Going?

Bitcoin Crashing Further: Price Action and Market Structure

Dear Bitcoiners,

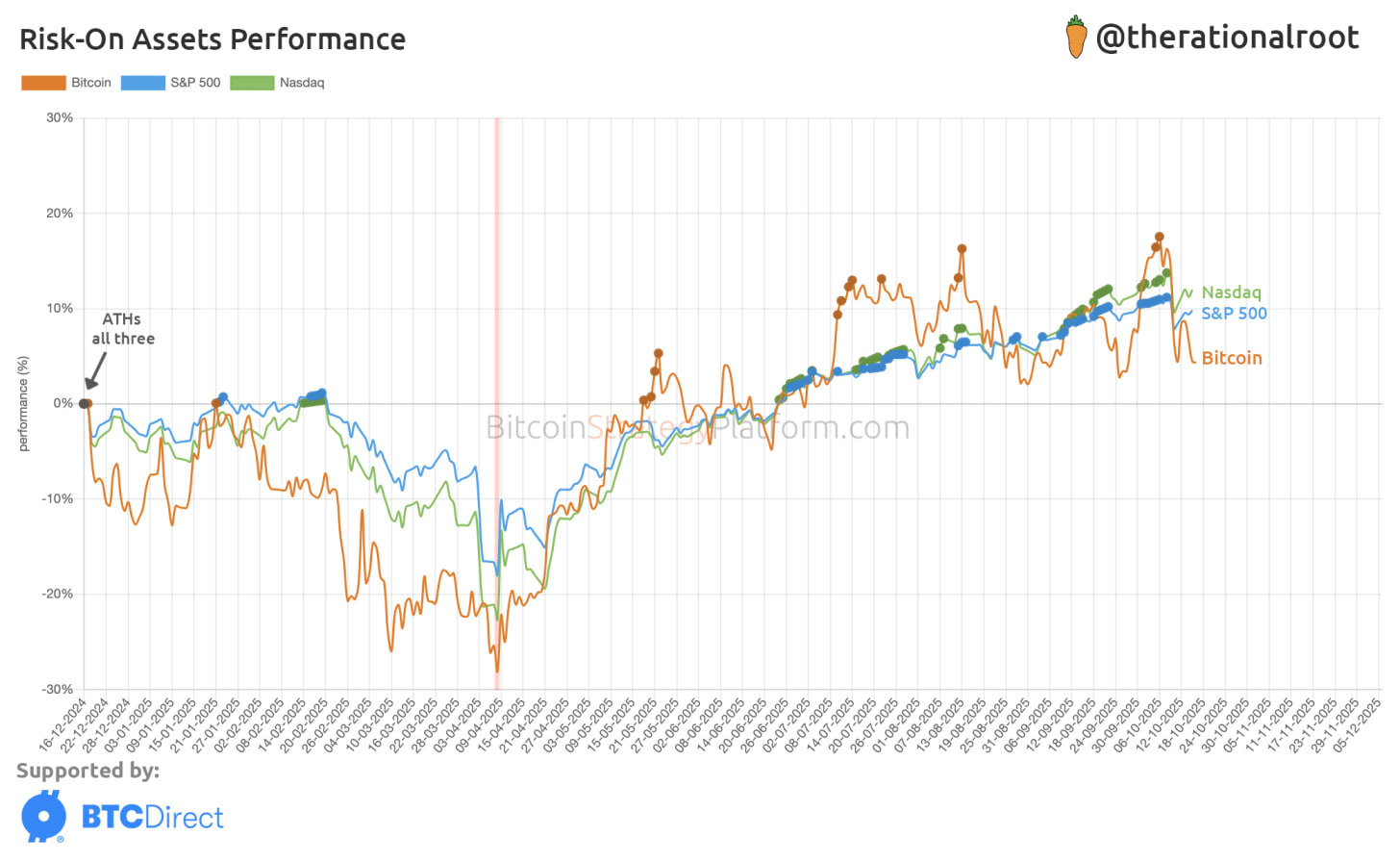

What a week we’re having, and what a change in sentiment. It’s only been 10 days since the ATH, and we’ve seen an absolute massacre in the crypto market and derivatives. If you’re focused solely on Bitcoin and holding spot, the situation is less severe. We’re currently at a ~15% drop, which, for a bull market, is common. However, if you were playing leverage games or in altcoins, you’re probably having a much rougher experience.

If this week is rough for you, I hope you understand why, at Bitcoin Strategy, we mainly focus on Bitcoin. The world has over $900 trillion of value, for which Bitcoin is a solution, and Wall Street is realizing its value as digital gold. JPMorgan recently came out with a new phrase, “the debasement trade,” which means using fiat that will be printed out of thin air and putting it into hard assets, mentioning gold and Bitcoin. That said, gold is soaring, but Bitcoin is not. Is gold’s massive rally telling where Bitcoin is going?

In this newsletter, we’ll answer that question and do a market analysis, breaking down the current situation. Then, we’ll use on-chain indicators to provide insights on where we might go from here.