From Capitulation to Elevation: Zooming into the Long-Term Holder Cost Basis

Shifts in Holder Behavior Shape Bitcoin's Future.

Over the past couple of weeks we have mainly focused on what to expect from Bitcoin on a short to medium term time frame by analyzing Short-Term Holder behavior. If you missed one of these newsletters, you can find them here. I specifically recommend last week’s newsletter, explaining the current change in trend regarding Short-Term Holders.

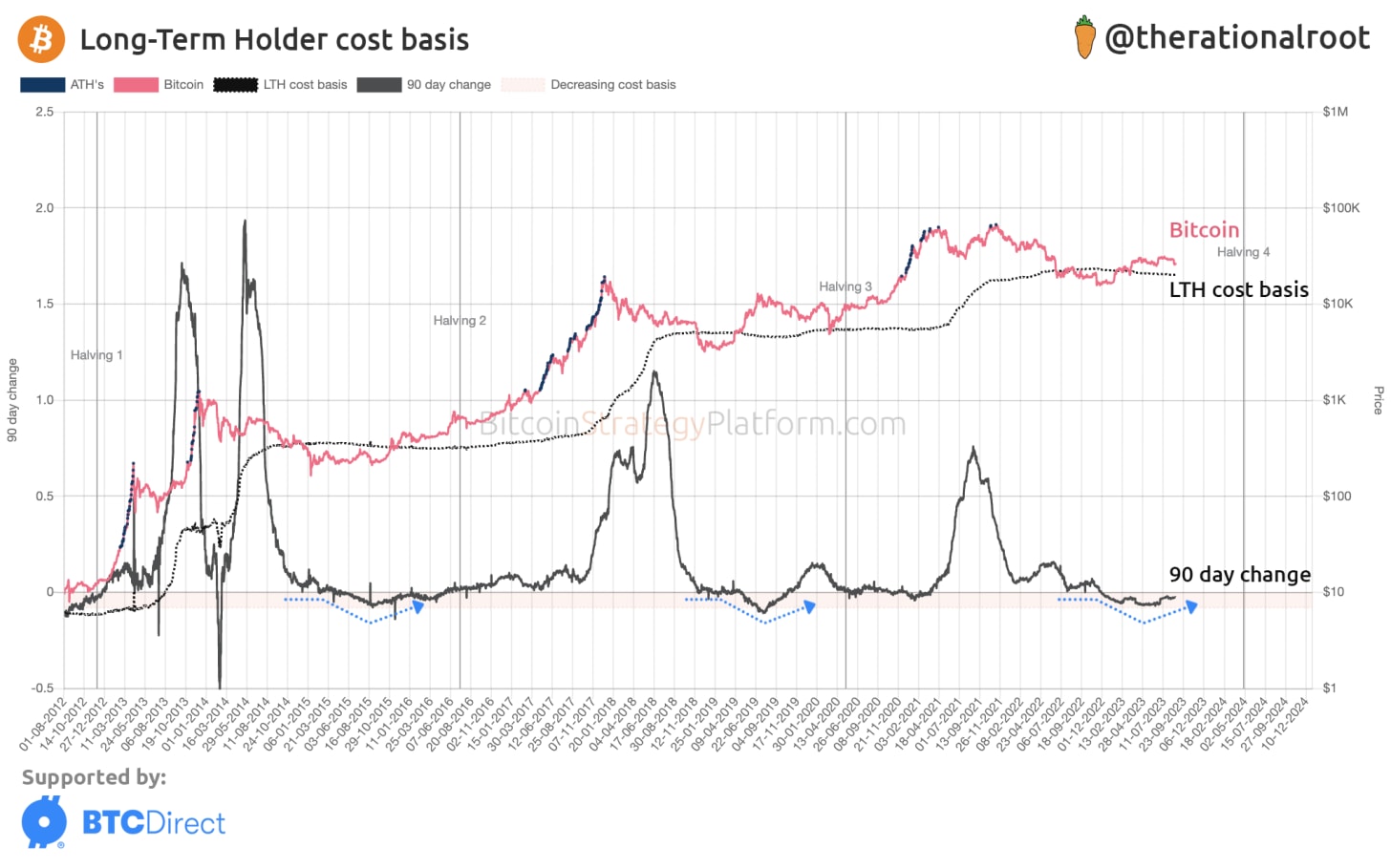

Today, however, we’ll focus on the behavior of the Long-Term Holder and particularly their cost basis. Analyzing the LTH cost basis and its cyclical behavior helps us understand if we’re on track in the broader cycle. LTH’s, as implied by its name, are generally not chasing near term price action but are focused on a longer time frame.

In the chart below, we observe two metrics: the LTH cost basis and the 90 day change of that cost basis. For analysts and investors with a long-term view, these metrics prove invaluable. Both metrics are now live available on the 👉 Platform!

👆 Live chart available.

Zooming into the Long-Term Holder Cost Basis

More than just a statistical average, the Long-Term Holder Cost Basis serves as an indicator of the continuation of the long-term investor behavior. It helps us gauge the average price paid by committed long-term investors, and the shifts in this metric offer valuable insights into market sentiment and dynamics:

Sentiment's Shift: A slow rise in the average acquisition price can signal bullish sentiment among the most steadfast Bitcoin investors.

Market Tendencies: The dance between the current Bitcoin price and the long-term holder cost basis paints a story of broader market shifts, providing cues for possible trend directions.

Price Dynamics and Investor Sentiment

Bitcoin's price trajectory, when juxtaposed against the long-term holder cost basis, provides an insightful window into market psychology:

Increase in Hodlers: During extreme heights in the Bull markets, newcomers entering the market cause the cost basis to go up as they transition into long term holders (defined by holding onto Bitcoin for over 5 months). This is where the Long Term holder reaches a new plateau.

Get access to the Bitcoin Strategy Platform with LIVE charts & Full content. 30% discount ending soon!

Using the 90 day change

Bitcoin's past is rich with lessons, and every market cycle offers insights. Certain reactions and behaviors repeat themselves across market cycles. Recognizing these patterns provides a vantage point for forecasting. Tools like the 90-day change can be leveraged to gain a macro perspective focusing on the bigger picture and setting aside the short-term noise. Bitcoin’s Long Term Holder cost basis has made a new plateau every cycle. Diving into the plateau, what looks like a steady trend, is actually full of information once we zoom in. This is where the 90 day change is useful: