Catalyst: The U.S. Election

Price Action, Scarcity-Driven Growth & Supply Dynamics

Dear Bitcoiners,

The U.S. election is coming up, and unlike previous cycles, its outcome may significantly impact Bitcoin! While Bitcoin just tested its all-time highs, it couldn’t quite push through. This week, however, MicroStrategy made a major announcement that could affect Bitcoin’s supply dynamics. In this newsletter, we’ll cover everything you need to know about the election’s potential impact on Bitcoin, current price action, and how MicroStrategy’s new plan could affect Bitcoin’s supply dynamics.

Catalyst: The U.S. Election

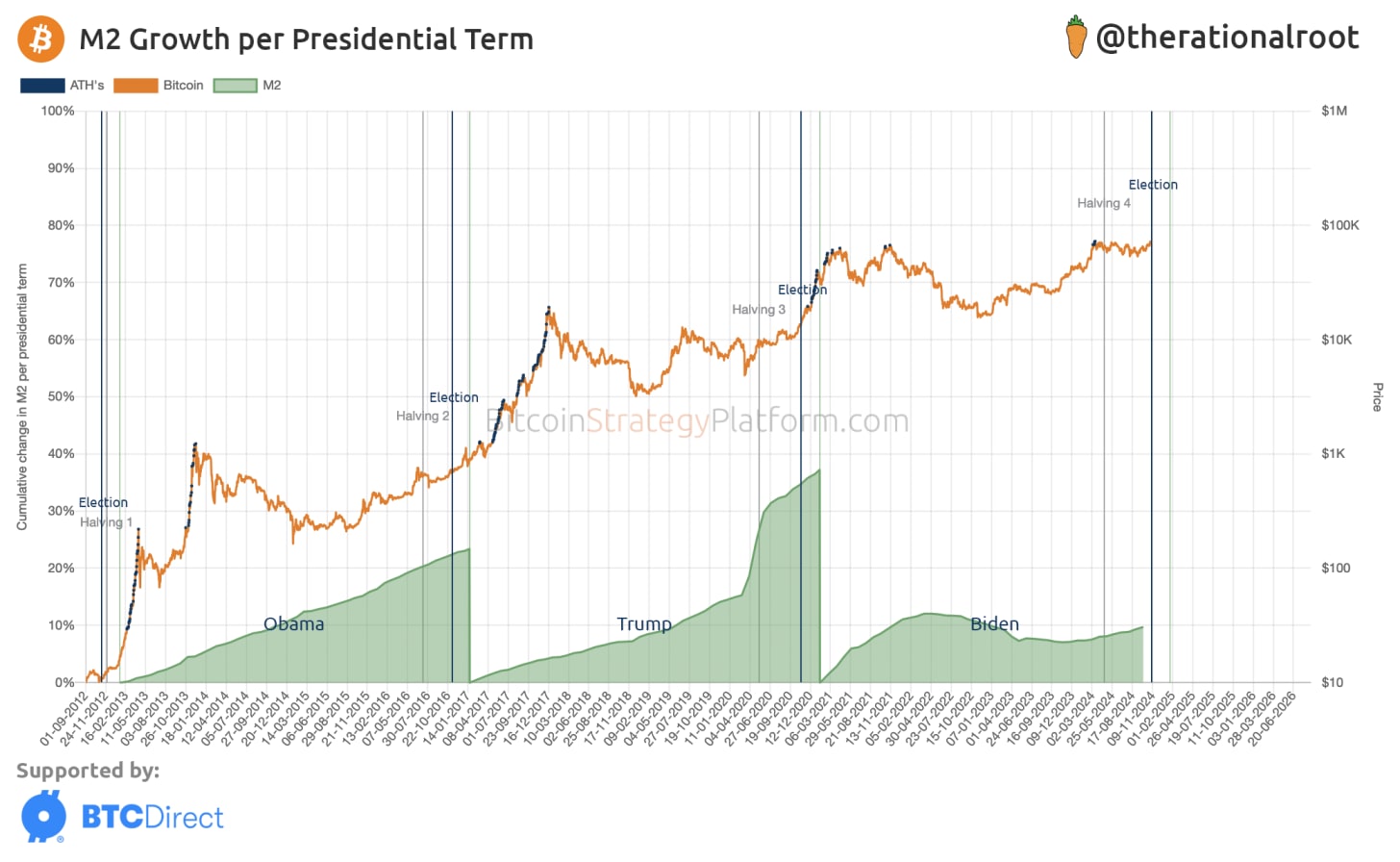

In the chart above, we observe the cumulative change in the U.S. Dollar Money Supply (M2) across presidential terms. The blue vertical line marks Election Day, followed by the green vertical line marking the start of each presidential term (4-year period).

It’s evident that regardless of party—Republican or Democrat—the money supply continues to grow. The key difference is often just how the funds are allocated. Notably, while Obama’s second term (2013–2017) saw “usual“ growth, the end of Trump’s term saw a surge due to COVID-19 relief measures. This trend continued into Biden’s term until 2022, when inflation pressures forced a temporary slowdown. Now, two years later, we’re seeing growth resuming along its usual trajectory.

Is This Time Different?

This is the first election where Bitcoin plays a major role. Although Bitcoin itself is non-partisan, Trump has promised a favorable stance, while Kamala Harris has not provided any detailed insights on the industry.

Trump’s personal understanding of Bitcoin is limited, but several of his close advisors, such as Vivek Ramaswamy and Robert F. Kennedy Jr., have shown significant insight. Additionally, Senator J.D. Vance has closely collaborated with pro-Bitcoin Senator Cynthia Lummis.

Trump’s Promises:

A Strategic Bitcoin Reserve

Mining-friendly policies

More favorable SEC policies (end of Choke Point 2.0), including firing Gary Gensler

Pardoning Ross Ulbricht on Day One

Kamala Harris hasn’t made any direct promises related to Bitcoin, Mark Cuban recently speculated that she also might replace SEC Chairman Gary Gensler.

While I remain neutral in political endorsements, it’s undeniable that Trump has a more favorable stance towards Bitcoin. As such, a Trump victory could likely serve as a catalyst for the industry.

When people ask me about the biggest risk to Bitcoin’s adoption, my answer is always “government fiscal responsibility.” Ironically, a Trump victory would mean Elon Musk will be tasked with overseeing government efficiency. Generally, governments always grow over time, as politicians rarely vote against their own interests, especially with access to unlimited money printing. Elon, however, has shown a commitment to cutting inefficiencies, as seen with Twitter.

Now, let’s dive into Bitcoin’s recent price action, scarcity-driven growth, and supply dynamics.

Get access to the best premium live indicators and charts, all in one place, to stay fully prepared for Bitcoin's cycle. Sign up today and get a 25% lifetime discount!